Solana’s DEX Ecosystem and Market Concentration

Published: 2024-10-09

Updated: 2024-10-09

With Solana’s DeFi ecosystem making great strides in 2024 with record volumes being traded, the memecoin and celebrity coin frenzy ongoing, and the influx of new participants and capital, it has helped propel projects who have been building through the bear gain a solid base of users and revenue. These OG projects have been rewarded handsomely for their dedication, and many have capitalized on Solana’s core features to offer experiences only available on Solana. Although great, there is room for improvement and competition to come in within the ecosystem to ensure that consumers maximize their value.

Specifically within the Decentralized Exchange (DEX) ecosystem, we can separate out a few major categories:

- Swap Aggregators: These aggregators focus on finding the best route for users by accessing the liquidity on DEXes

- Swap DEXes: These DEXes focus on allowing users to swap tokens like for like on their platform

- Perpetual DEXes: These DEXes focus on allowing perpetual futures trading on their platform

Swap Aggregators

Currently, there is one dominant player in the DEX aggregation business. This is of course Jupiter. There may be others in the space, but they either not gained traction, been shown to have just been routing through Jupiter’s API, or seem to have minimal development. Users on Solana are left with one choice if they want to get a better price as logically, if you can route through multiple pools, that is better than just routing through one platform’s pools.

The reason that there is only one player in this space while there are many within the EVM side is the difficulty of designing a high throughput system that can effectively manage the speed at which Solana can process transactions. This has led generally to more inefficient routing paths than those currently offered in the EVM space.

In addition, Jupiter has managed to gain substantial market power by being the entry point for which users swap tokens. They originate a significant amount of DeFi transactions on Solana and act as the main page for trading on Solana.

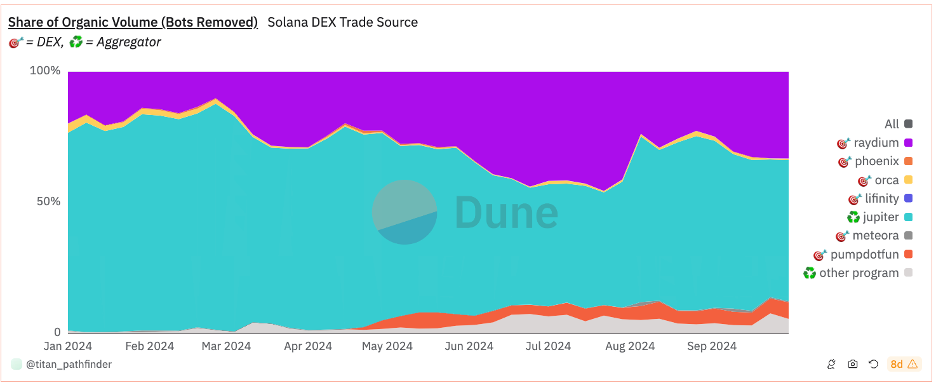

As seen above, Jupiter originates 54% of all Defi Transactions. Raydium has managed to turn around the trend a bit recently and regained some order origination power due to the memecoin trend, which is interesting in of itself, but we would probably expect that this trend would revert given enough time.

With the launch of Titan, a new Solana DEX aggregator, there will be more competition for users’ demands to always get the best price. With Titan’s leading algorithms and comparative win rate of 81% against competitors, users will be able to get a better price when trading, and the ecosystem will gain a valuable force to foster competition and enforce decentralization to the benefit of all.

Swap DEXes

These DEXes come in a few flavors on Solana:

- Constant Product Pools: Relies on the constant product mathematical relationship pioneered by Uniswap V2. The primary venue for these pools is Raydium, although Orca’s splash pools replicate this functionality.

- Concentrated Liquidity Pools: Relies on bucketing liquidity into ticks pioneered by Uniswap V3. Orca has been at the forefront in this category and consistently provides top tier liquidity for the most liquid tokens.

- Order Book: A traditional order book system as implemented by almost all traditional finance systems

Most DEXes on Solana use one or a combination of these pool methodologies to power their protocols. Of particular interest are order book based DEXes.

On Solana, order book based DEXes are feasible due to the high throughput and low fees of the blockchain. This enables liquidity to be used far more efficiently than any Automated Market Maker. There are many projects on EVM proposing the same thing, but they are almost all based off of running the order book off-chain and then just doing the settlement on-chain. Solana Order Book DEXes on the other hand do everything, from order placement, updates, cancellations, and execution on-chain which is a revolutionary model.

Although there are a lot of DEXes being released, only a few have managed to drive volume through their platforms. This is through a combination of Jupiter being the gatekeeper and what users are comfortable with.

Perpetual DEXes

Due to the unique nature of Solana, which includes its throughput, low costs, and programming structures, users looking for Perpetual DEXes have a wide variety of choices. From Drift to Jupiter Perps to Zeta, there are a lot of different implementations where users can find the appropriate products for them. In addition, Zeta Markets is leading the way with building an L2 on top of Solana to further improve their product. These projects have been extremely lively and on the edge of innovation within the space with considerable competition to ensure that users get good pricing. Currently, there are no Perpetual DEX aggregators that are live to the general public.