Titan Solana Swap Market Report - January 2025

Published: 2025-02-03

Updated: 2025-02-03

We are excited to bring you the 4th edition of Titan’s State of Solana’s Swap Markets report for January 2025 where we focus on DEX Aggregators. As always, please note that the data used is from Dune and although fairly accurate, crypto data in particular should be used more on a relative basis and as a heuristic rather than a focus on the absolute values given large gaps and differences in data between different providers.

The big news in the DeFi space was the launch of the TRUMP and MELANIA memecoins which saw record amounts of volume flowing throughout the ecosystem. This caused a ripple effect throughout the entire ecosystem. An excellent overview can be found here with commentary from the Titan team detailing the impact on the Solana ecosystem and how the blockchain as well as projects handled the increase in order flow.

Swap Aggregation Market

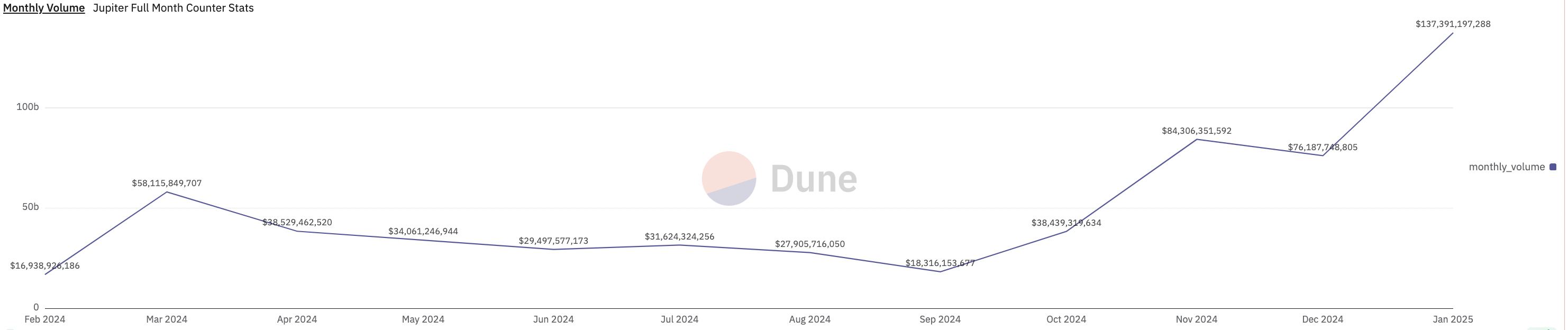

In the first half of January 2025, the month was actually looking fairly weak in terms of volume as compared to December. The Solana ecosystem was on track to do around $59B in volume, but then came the launch magic of TRUMP and MELANIA.

This propelled the ecosystem to heights that we have not seen before with January actually ending with $137B in volume. Not only was there a massive spike around the launch dates, but this momentum carried through and sustained itself. This was a watershed moment for Solana where January had 80% more volume than December and 63% more than the all time high in November.

The number of swaps continued to reach new all time highs with 281M being done, an increase of 20% over the previous month, which was also an all time high. Even though there were more swaps, the volume being done far outpaced this as large traders moved even more size and volume through Solana’s on-chain markets. Smaller traders kept around the same percetnage of volume, but it was the whales who truly commited with around 2X-5X more in volume in January.

Venues

January was an absolutely fascinating month when looking at tradeable venues. With Meteora handling the TRUMP token launch, its percentage of the market share shot up to 17.6%, which it took directly from Raydium. Although interesting, it does not reflect an underlying change in the ecosystem as normal market share re-exerted itself shortly after.

Most interestingly is the volume being done by SolFi and ZeroFi. ZeroFi popped up in the last 2 weeks of the month and already did 5.5% of the entire month’s volume. SolFi did 17.1% of the volume as well. With absolutely no information on the teams behind these projects and nobody knowing who they are, it can only be speculated as to how they have produced this much liquidity. It is suspected they use an oracle based DEX similar to Lifinity, but somehow has access to a method to quote in far larger sizes and offer better prices a lot of times. Time will only tell who these players are, but it is not usual behaviour for a market behaviour not to have methods to contact them so they can supply as much liquidity as they can.