Titan Solana Swap Market Report - March 2025

Published: 2025-04-03

Updated: 2025-04-03

We are excited to bring you the 6th edition of Titan’s State of Solana’s Swap Markets report for March 2025 where we focus on DEX Aggregators. As always, please note that the data used is from Dune and although fairly accurate, crypto data in particular should be used more on a relative basis and as a heuristic rather than a focus on the absolute values given large gaps and differences in data between different providers.

Without the lack of a major crypto centric catalyst, markets continue to move with traditional financial markets in a month where investors are becoming increasingly worried about economic conditions stemming from President Trump’s tarriff measures. Accordingly, there has been continued downward pressure on prices across all asset classes. Again, we would like to remind users that the volumes are still a significant growth rate year over year.

Swap Aggregation Market

March was an exciting time for the DEX Aggregation market in Solana. Competition has heated up with Titan launching its private beta to public users for its Meta-Aggregation product and Kamino’s Meta Swap product. Price competition is finally here and users can start seeing continued innovation in an attempt to provide users the best prices once again.

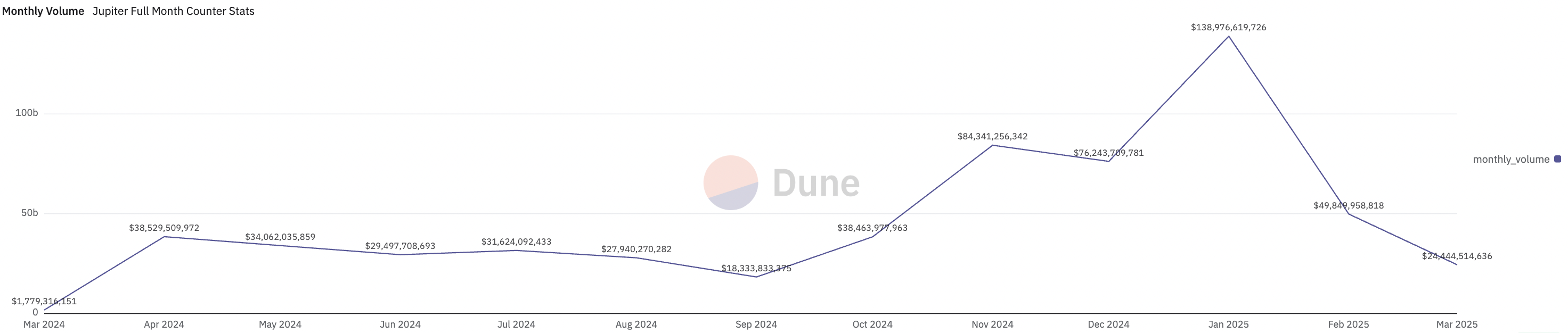

The Solana DEX Aggregation market processed around $24.4B in volume in March, which reflects a 51% decrease in volume as compared to last month. This shows that the sustained sell pressure from macro events and drag from the memecoin fallout continue to perpetuate.

Surpringly, the number of swaps has held up with it only dropping 12% to 123M swaps. In fact, the number of unique wallets saw a 12% increase to 6.4M. The silver lining here would be that although volumes have dropped overall, users are still sticking around and placing trades, although in smaller sizes as they cautiously test out the market. Once sentiment changes, we will see a huge pickup from these traders.

Venues

With pump.fun launching pump swap, this has shaken up exisiting dynamics heavily. While we did not get to collecting data on pump swap in time, we can already see the impact this is having on the overall market.

Raydium in particular has taken huge losses in market share losing around 10%. we can presume that this volume was replaced by pump swap in particular as new memecoins launch and continue to graduate to the pump swap instead of Raydium. Depending on what Raydium does, this trend may continue to accelerate as more memecoins continue to flow outside of Raydium.

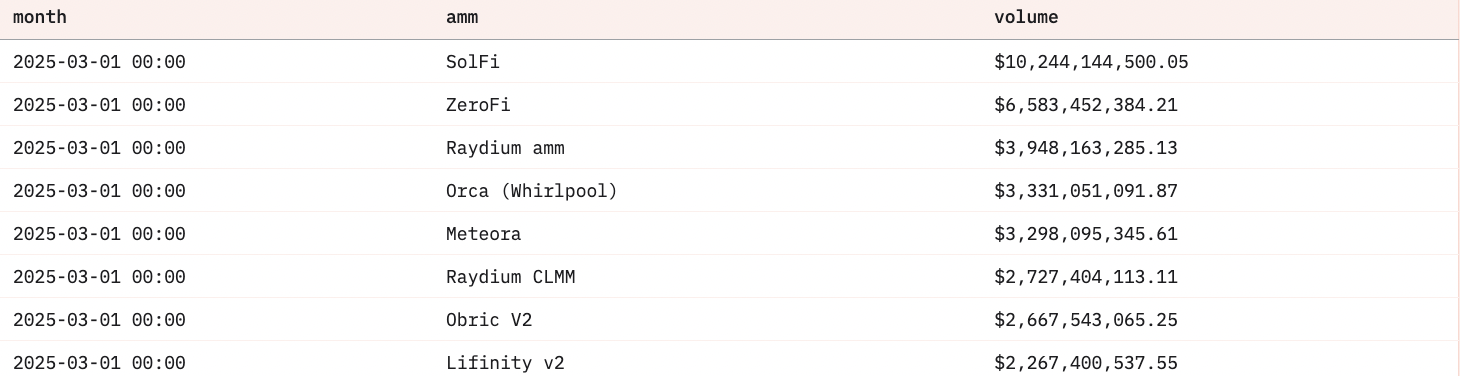

SolFi and ZeroFi continue to dominate with 24% and 15% of volume now. These market makers are doing something right in terms of providing the best liquidity to traders and cannot be overlooked. This has resulted in continuing shrinking market share for other DEXes as the majority of activity in this market has been concentrated on major pairs, especially SOL, USDC, and USDT.

Tokens

In this type of market, traders usually flock to safety, which explains the concentration in SOL, USDC, and USDT. In fact, we have seen SOL increase its concentration to 72% and USDC to 69%. In addition, international markets are diving into Solana more with USDT rising ot 15.6%. Other notable coins that were highly traded were all blue-chip tokens showing that traders are concentrating their assets in tokens they know will have sustainable or stable value over time as they ride out the downturn.