Titan Solana Swap Market Report - November 2024

Published: 2024-12-03

Updated: 2024-12-03

We are excited to bring you the 2nd edition of Titan’s State of Solana’s Swap Markets report for November 2024 where we focus on DEX Aggregators. As always, please note that the data used is from Dune and although fairly accurate, crypto data in particular should be used more on a relative basis and as a heuristic rather than a focus on the absolute values given large gaps and differences in data between different providers.

As everyone knows, the U.S. elections concluded on November 6, 2024 with Donald Trump being elected as the incoming President. The entire market has seen a massive upsurge as traders see a far more favourable regulatory environment and support from the U.S. to support the nascent crypto industry. Prices have gone up dramatically as well with Bitcoin approaching the $100,000 price level and SOL reaching an all-time high of $263.83.

Swap Aggregation Market

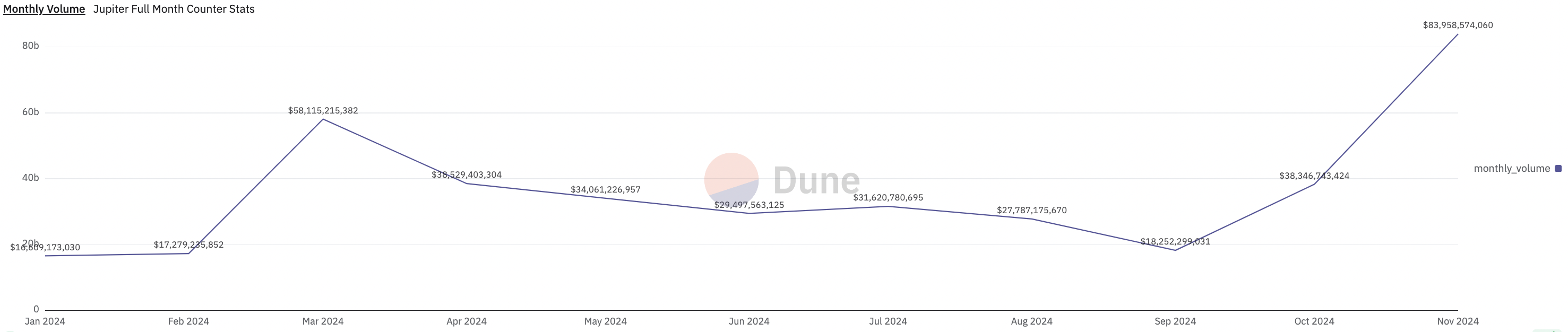

In November 2024, volume being put through DEX aggregators has gone up significantly with $84 billion as compared to $38 billion last month representing a 121% increase. In particular, since the election, volume continued to grow at an exponential pace until stabilizing at a consistent growth rate during the last week of November

This increase in volume has been mainly driven by existing users upsizing their trades and using their dry powder. Although Solana also saw a record number of swaps (211M) with it growing 39% from last month, this is not enough to account for the massive increase in volumes. Animal spirits are certainly on the rise as traders confidently deploying their capital fully.

In addition, more wallet addresses have interacted with aggregators this month with 4.3 million. Hopefully these addresses represent new users being drawn into the ecosystem due to the dynamic growth it is currently experiencing.

Venues

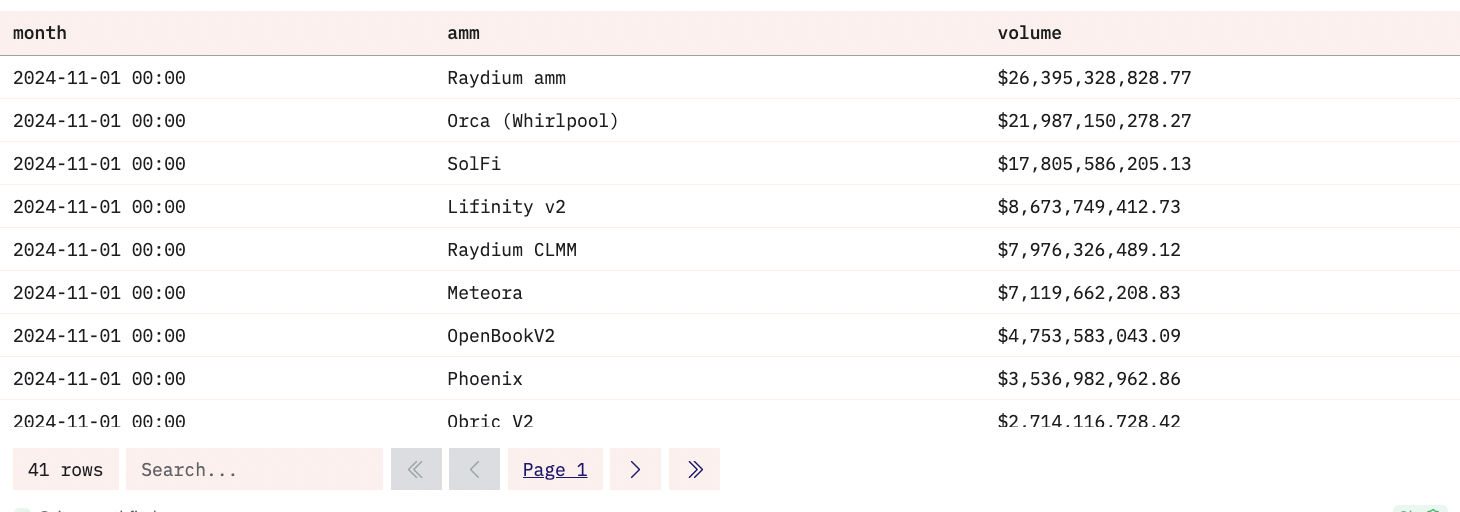

In such a strong market, almost all DEXes that supply liquidity to aggregators saw a massive increase in volume running through their pools. In particular, Raydium saw order flow of $26 billion as compared to $12 billion last month. Driven by a resurgence in memecoins, Raydium nevertheless lost market share dropping to 22% from 32% last month.

This is mainly due to a few new players on the block including Stabble, Obric, and especially Solfi. Solfi in particular has come out of nowhere to now make up 17% of liquidity from aggregators with it actually providing the most liquidity to SOL-USDC. Solfi seems to focus particularly on USDC pairs to major tokens, which gives the impression that it uses a sort of market maker model or oracle based amm model like Lifinity. Please see this post by Yash for more context.

Stabble and Obric both have also come up recently making up around 2.5% of liquidity each. Stabble really outperforms on stablecoin swaps, especially USDT-USDC, as they have extremely efficient mechanisms for their pools.Obric on the other hand is an example of a Lifinity like amm, but its oracle has had issues in the past where it was allowing arbitrage of its LPs due to it massively under/overpricing SOL. An example of these mispriced transactions can be found here where the trader made 69 SOL in an arbitrage off of Obric.

Orca also gained market share to close to 21% and has around $22 billion in volume as compared to $7 billion last month. The improvements the Orca team have made to their underlying systems and making their docs more friendly to developers have certainly helped them grow.

Meteora on the other hand has lost significant market share going down to 6.7% from 10%. Users seem to be favouring Orca and Raydium significantly more with Solfi taking away a lot of SOL-USDC swaps.

Order book based DEXes, such as Openbook and Phoenix, have seen market share losses as the higher fees on Solana in this market have made it harder for market makers to support.

Origination

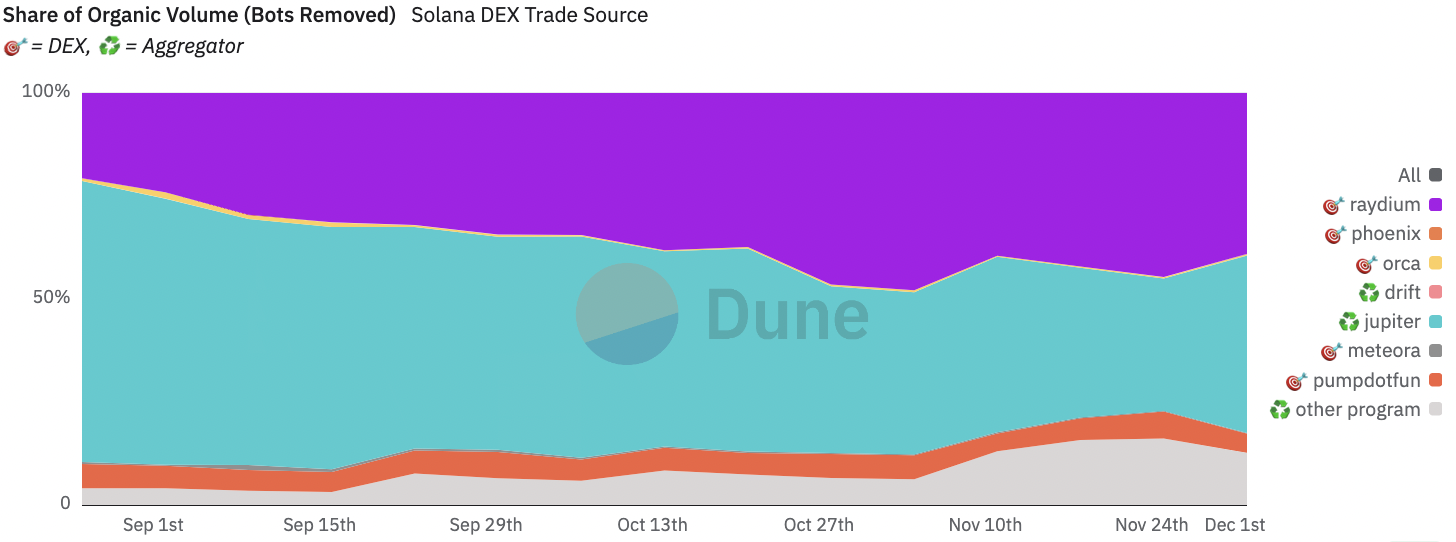

Order origination has settled down in November with a 40% market share between Jupiter and Raydium each. This seems to be the natural state currently. Of particular interest is the growth of origination from other programs indicating that more trading bots and enterprises are starting to get involved in the ecosystem, with it climbing to around 12-15% market share. Pumpfun remains consistently at around 5% indicating that the users who frequent there are a fairly consistent percentage of traders.

Tokens

SOL concentration has actually gone down in November to 70% from the 80% range last month, while USDC has increased from 37% to 55%. As pump.fun memecoins typically use pools with SOL, this would indicate that there is more USDC liquidity floating around now to provide direct liquidity to the larger token pairs, including GOAT, WIF, and the rest. This is especially interesting due to the solfi pools being predominantly USDC denominated ones and may indicate more users on-ramping their fiat and then directly trading to their desired tokens.

With GOAT and PNut staying within the top 10 traded coins, this does show that top tier new memecoins do have staying power.

On the stablecoin front, PYUSD has lost more market share. It is actually fairly consistent in its volume, but has lost significant market share and is now at 0.73%. No data on USDS yet from Dune, but it will be extremely interesting to see how it compares as we go along.