Titan Solana Swap Market Report - October 2024

Published: 2024-11-07

Updated: 2024-11-07

The Titan team is pleased to bring you the first of our new series detailing the state of the swap market on Solana with a focus on users using DEX Aggregators. Updates will be provided near the start of every month so that we can help the entire ecosystem learn what is happening in the exciting world of Solana DeFi. Please note that the data used is from Dune and that although fairly accurate, crypto data in particular should be used more on a relative basis and as a heuristic rather than a focus on the absolute values given large gaps and differences in data between different providers.

Swap Aggregation Market

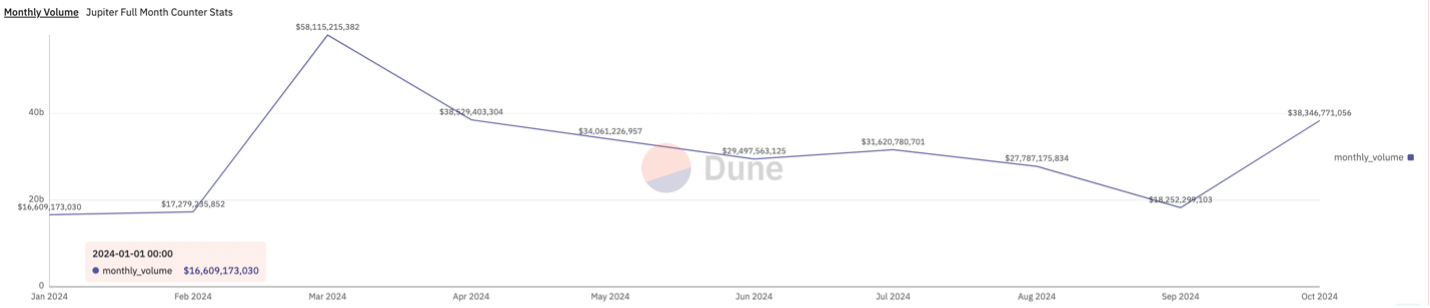

In October 2024, the volume flowing through aggregation has picked up a lot. Before September, monthly volume was hovering near the $30 billion mark before plunging in September to $18 billion. It recovered dramatically in October with it reaching $38 billion.

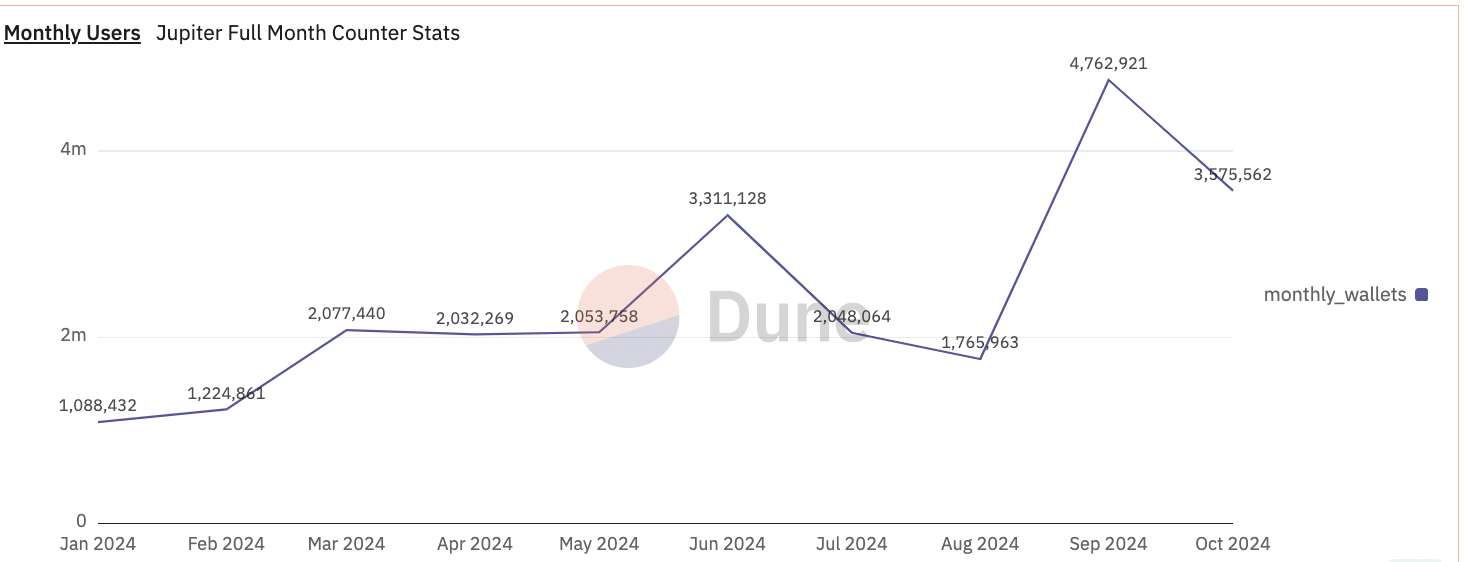

If we then take a look at the amount of users making trades, an interesting relationship occurs. There was a record 4.7 million users in September. We can make a causation here that the big events held in Asia in September heavily distracted significant proportions of traders on Solana who could not make the calls or pay as much attention as they could have normally thus contributing to the very low volume, but the events themselves helped to garner significant interest from 1st time users to try out the product. These users in particular experimented with very low trade sizes.

In October, many of these users stayed on Solana as they saw what the ecosystem could provide for them with low latency times and transaction costs. In addition to improving fundamentals on Solana, the market buoyed by renewed interest in memecoins through AI Agents (GOAT) and other narratives. This led to current users upsizing the amount of on-chain volume by more than double what they had previously. Spirits are certainly high and we look forwards to this continued momentum

Venues

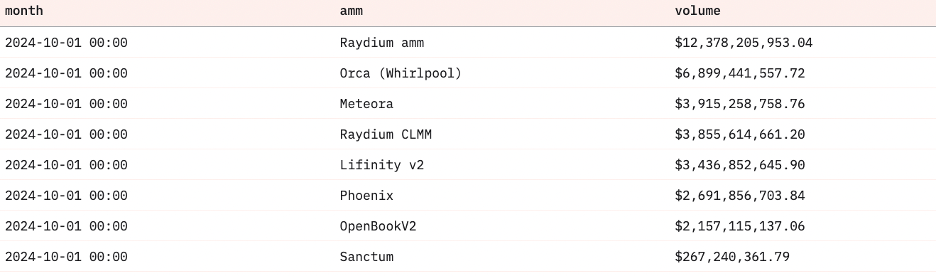

As mentioned previously with the renewed memecoin push, Raydium has regained a lot of volume due to being the main marketplace for such tokens. This has led Raydium Constant Product pools to grow the percentage of times aggregators routed to them from 15% market share to 32% with it processing $12 billion in October vs $5 billion last month.

Surprisingly, Lifinity also did very well as it got far more competitive in terms of pricing. This allowed them to move its aggregator contribution market share from 6% to 10%. Orca and Meteora have also maintained a steady growth in volume even as Raydium takes more market share.

Of particular note is that CLOB based AMMs have basically maintained the same volume as previous months, but as the market grew in size dramatically, the percentage of market share has dropped.

Origination

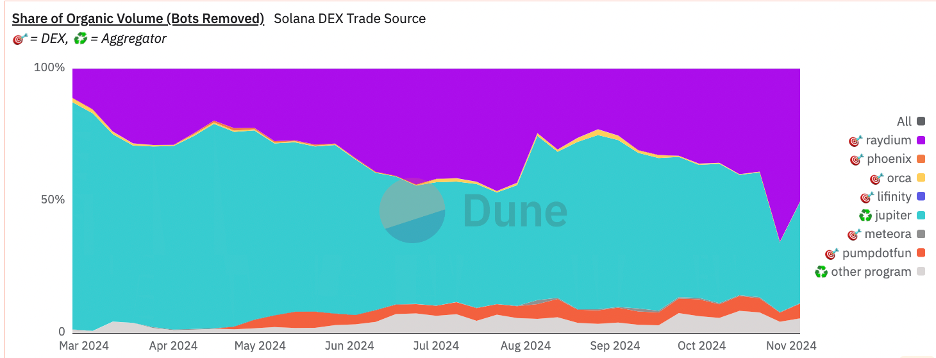

In regards to which platforms traders interact with to initiate their orders for non bot transactions, JUP has recently lost significant market share back to Raydium. This is due to the memecoin mania mentioned before and Jupiter not being able to land transactions effectively. This pushed Raydium origination to around 50% compared to 35% the month prior. Jupiter is still maintaining around a 40% origination rate. The market is still dominated by Raydium and Jupiter, with the only real challenger being pump.fun maintaining a steady 5%.

Tokens

The power of SOL as a token has stayed consistent with SOL being involved in around 75%-80% of all trades on Solana. What is more interesting is the decreasing importance of USDC, which has gone from 58% to 37%. We have seen this last month with PYUSD as Paypal removed its incentives for the token, but this trend seems to be more reflective of the fact that memecoins have taken significant volume away with SOL being used as the prime pair. This is further reinforced as USDT power has maintained fairly stable with its primary use case as a back up mechanism for USDC. PYUSD continues to decline in usage as it has dropped from 4.3% to 1.8% of volume.

Most interestingly in October is how quickly and how much traction GOAT gained within the month. Spearheaded by Truth Terminal and the blessings of the community of AI agents, GOAT has come out of nowhere to be the 4th most traded token in Solana unseating blue chip tokens easily. This shows that memecoins have significant potential and should not be ignored. In early November, this trend seems to be continuing with PNut being the 5th most traded token and the SOL-PNut pair being the 2nd most traded pair. Overall, it can be seen that more liquidity is being distributed into the long tail of assets.